Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India) sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

This comparison delves into the intricacies of car insurance quotes across the US, UK, and India, shedding light on the key factors, processes, and regulations influencing prices in each country.

Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India)

Car insurance quotes can vary significantly based on several key factors in the US, UK, and India. These factors include the driver's age, driving record, type of vehicle, location, and coverage options chosen. Let's explore how obtaining car insurance quotes and the role of insurance companies and regulations differ in these three countries.

Key Factors Influencing Car Insurance Quotes

In the US, factors such as the driver's age, driving history, credit score, and the type of vehicle play a significant role in determining car insurance quotes. Younger drivers and those with a history of accidents may face higher premiums.In the UK, car insurance quotes are influenced by similar factors, including the driver's age, driving experience, and the type of vehicle.

Additionally, the location where the car is parked overnight can impact insurance prices.In India, factors such as the age of the vehicle, the city of registration, and the type of coverage selected can affect car insurance quotes. Insurers also consider the cubic capacity of the vehicle's engine when calculating premiums.

Process of Obtaining Car Insurance Quotes

In the US, drivers can obtain car insurance quotes online through insurance company websites or comparison websites. They can also contact insurance agents directly for quotes based on their specific needs.In the UK, drivers can compare car insurance quotes online through comparison websites or directly from insurance companies.

The process typically involves providing detailed information about the driver, vehicle, and coverage preferences.In India, drivers can obtain car insurance quotes online through insurance company websites or third-party comparison portals. The process usually requires entering details about the vehicle, previous insurance history, and desired coverage options.

Role of Insurance Companies and Regulations

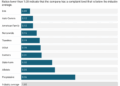

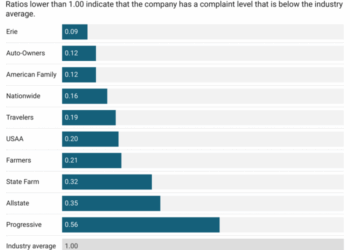

Insurance companies in the US, UK, and India play a crucial role in determining car insurance prices based on risk assessment, market competition, and regulatory guidelines. Regulations in each country set standards for insurance coverage, pricing transparency, and consumer protection.Popular insurance providers in the US include Geico, Progressive, and State Farm, each offering competitive pricing and various coverage options.

In the UK, popular insurers like Aviva, Direct Line, and Admiral provide comprehensive coverage at competitive rates. In India, insurers like ICICI Lombard, HDFC ERGO, and Bajaj Allianz offer diverse coverage options tailored to the needs of Indian drivers.

Factors Affecting Car Insurance Quotes

When obtaining car insurance quotes, several factors come into play that can influence the premiums you are quoted. These factors vary from country to country, but some common elements include age, driving history, vehicle type, and location.

Age

Age is a significant factor that affects car insurance quotes across the US, UK, and India. Younger drivers typically face higher insurance premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Driving History

Your driving history plays a crucial role in determining car insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or tickets may result in higher quotes.

Vehicle Type

The type of vehicle you drive also impacts your car insurance rates. Generally, expensive or high-performance cars will cost more to insure compared to standard vehicles due to the increased cost of repairs or replacements.

Location

Your location can influence car insurance quotes as well. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas with lower risk factors.

Credit Scores

In the US, credit scores play a significant role in determining car insurance rates. Insurers often use credit information to assess the risk of a policyholder, with lower credit scores potentially leading to higher premiums. On the other hand, credit scores do not have the same impact on car insurance rates in the UK and India.

Car Safety Features

Car safety features can also impact insurance premiums in all three countries. Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision warning systems may qualify for discounts on insurance premiums as they reduce the risk of accidents and injuries.

Comparison of Coverage Types

When it comes to car insurance, understanding the different coverage types available in the US, UK, and India is crucial for car owners to make informed decisions about protecting their vehicles. Let's explore the variations in basic and comprehensive coverage options, as well as the differences in third-party liability coverage and popular optional add-ons in these regions.

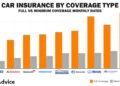

Basic vs. Comprehensive Coverage

In the US, basic car insurance typically includes liability coverage required by law to cover damages to others in an accident. Comprehensive coverage, on the other hand, offers protection for damages to your own vehicle from non-collision incidents like theft, vandalism, or natural disasters.In the UK, basic car insurance is known as third-party only (TPO) insurance, covering liability for injuries or damages to others but not for your own vehicle.

Comprehensive coverage in the UK includes TPO benefits along with coverage for your own vehicle in case of accidents or damages.In India, basic car insurance is similar to TPO in the UK, providing coverage for third-party liabilities. Comprehensive coverage in India extends this protection to include damages to your own vehicle from accidents, theft, or natural calamities.

Third-Party Liability Coverage

In the US, third-party liability coverage is a mandatory component of basic car insurance, ensuring that you are financially protected in case you cause harm to others while driving. This coverage helps pay for medical expenses, property damage, and legal fees resulting from an accident where you are at fault.In the UK, third-party only insurance is the minimum legal requirement, covering liabilities for injuries or damages caused to others by your vehicle.

This coverage does not include protection for your own vehicle or personal injuries.In India, third-party liability coverage is also mandatory, providing financial protection against claims from third parties for injuries or damages caused by your vehicle. This coverage is essential for legal compliance and financial security in case of accidents.

Optional Coverage Add-Ons

In the US, popular optional coverage add-ons include uninsured/underinsured motorist coverage, which protects you if you are in an accident with a driver who has insufficient insurance. Additionally, roadside assistance coverage and rental reimbursement coverage are common add-ons for extra peace of mind.In the UK, popular optional add-ons for car insurance include breakdown cover, which provides assistance if your vehicle breaks down, and legal expenses cover, which helps with legal costs in case of disputes related to your vehicle.In India, car owners often opt for add-ons like zero depreciation cover, which ensures full claim without deductibles for depreciation of car parts, and engine protector cover, which safeguards the vehicle's engine from damages not covered under standard insurance.

Technology Impact on Insurance Quotes

Technology plays a crucial role in shaping the landscape of car insurance pricing globally. From telematics and IoT devices to online platforms and comparison websites, advancements like AI and big data are revolutionizing the way insurance companies assess risk and determine premiums.

Telematics and IoT Devices

Telematics devices, often installed in vehicles, collect data on driving behavior such as speed, braking patterns, and mileage. This data is then used by insurance companies to assess risk more accurately, leading to personalized premium rates for drivers. Similarly, IoT devices like smart dashcams and sensors offer real-time data on driving habits, allowing insurers to offer usage-based insurance policies tailored to individual drivers.

Online Platforms and Comparison Websites

The rise of online platforms and comparison websites has made it easier for consumers to shop for car insurance quotes. These platforms allow users to compare multiple quotes from different insurance providers, helping them find the most competitive rates. Additionally, online tools provide transparency and convenience, empowering consumers to make informed decisions about their insurance coverage.

Advancements in AI and Big Data

Artificial intelligence and big data analytics are transforming the insurance industry by enabling companies to analyze vast amounts of data quickly and accurately. AI algorithms can assess risk factors, predict claim likelihood, and detect fraudulent behavior, leading to more precise pricing models.

By leveraging big data, insurers can offer personalized policies based on individual driving behaviors and trends, ultimately improving customer experience and reducing costs.

Final Summary

In conclusion, this exploration of car insurance quotes in the US, UK, and India unveils a tapestry of insights into how various elements impact pricing and coverage options across different regions.

FAQ Summary

What are the key factors influencing car insurance quotes in the US, UK, and India?

Factors include driving history, age, vehicle type, and location, among others. Regulations and insurance companies also play a pivotal role in determining prices.

How do credit scores affect car insurance rates in the US, UK, and India?

Credit scores can impact rates differently in each country, with the US placing significant emphasis on credit scores compared to the UK and India.

What are the differences between basic and comprehensive coverage options in the US, UK, and India?

Basic coverage offers minimal protection, while comprehensive coverage provides extensive coverage for various scenarios.

How does technology like telematics influence car insurance pricing in the US, UK, and India?

Telematics and IoT devices can impact pricing by providing real-time data on driving behavior, allowing for more personalized insurance rates.

How do online platforms and comparison websites assist consumers in shopping for car insurance quotes?

These platforms simplify the process by allowing users to compare quotes from multiple insurers, facilitating informed decision-making.