Beginning with Discount Car Insurance Quotes: How to Use Date of Birth & Driving History to Your Advantage, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the impact of age and driving history on car insurance quotes opens up a world of possibilities for obtaining better rates and coverage.

How Date of Birth Impacts Car Insurance Quotes

When it comes to car insurance quotes, the date of birth plays a significant role in determining the premiums individuals will pay. Insurance companies use age as a key factor in assessing risk and setting prices for coverage. Let's dive into how age impacts car insurance quotes.

Younger Age Groups

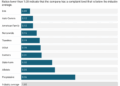

Younger drivers, typically those under the age of 25, are considered higher risk by insurance companies. This is due to statistics that show younger drivers are more likely to be involved in accidents. As a result, younger age groups often face higher insurance premiums compared to older drivers with more experience on the road.

Older Age Groups

On the other end of the spectrum, older drivers, particularly those over the age of 65, may also see differences in car insurance quotes. While older drivers are generally considered more experienced and safer on the road, age-related factors such as declining vision or slower reaction times can impact insurance rates for this age group.

Why Age Matters to Insurance Companies

Insurance companies use age as a factor in determining car insurance quotes because it is closely linked to risk. Younger drivers are seen as riskier due to their lack of experience, while older drivers may face increased risk due to age-related factors.

By analyzing age demographics, insurance companies can assess the likelihood of a driver making a claim and adjust premiums accordingly.

Utilizing Driving History for Better Insurance Rates

Having a clean driving record can significantly impact the cost of your car insurance premiums. Insurance companies often view drivers with a history of safe driving as lower risk, thus offering them lower rates compared to those with a record of violations and accidents.

Impact of Violations on Insurance Premiums

- Speeding Tickets: Speeding tickets can lead to an increase in insurance premiums as they indicate a disregard for traffic laws and safety.

- Accidents: Being involved in accidents, especially those deemed to be your fault, can result in higher insurance costs due to the increased risk associated with your driving behavior.

- DUI/DWI: Driving under the influence or driving while intoxicated violations can have severe consequences on insurance rates, often resulting in a significant spike in premiums.

Tips for Improving Driving History

- Follow Traffic Laws: Obeying speed limits, traffic signals, and other road rules can help maintain a clean driving record.

- Defensive Driving Courses: Taking defensive driving courses can not only improve your driving skills but also demonstrate to insurance companies your commitment to safe driving.

- Regular Vehicle Maintenance: Keeping your vehicle in good condition can help prevent accidents caused by mechanical failures, thus contributing to a positive driving history.

- Avoid Distractions: Minimizing distractions while driving, such as texting or using a phone, can reduce the risk of accidents and violations.

Strategies for Leveraging Date of Birth and Driving History

When it comes to getting the best car insurance rates, leveraging your date of birth and driving history can make a significant difference. Insurance companies often use these factors to assess risk and determine the cost of your policy. By understanding how age and driving record impact insurance rates, you can take steps to negotiate better premiums.

Categorization of Age Groups and Driving Records for Insurance Purposes

| Age Group | Driving Record | Insurance Category |

|---|---|---|

| Under 25 | Clean Record | Lowest Rates |

| 25-45 | Minor Violations | Moderate Rates |

| 45-65 | No Accidents | Preferred Rates |

| 65 and Above | Experienced Driver | Discounted Rates |

Using Age and Driving History to Negotiate Better Rates

- Know your driving history: Obtain a copy of your driving record to ensure its accuracy.

- Highlight safe driving habits: Emphasize any defensive driving courses or certifications you have completed.

- Show consistency: Maintain a clean driving record over time to demonstrate responsible behavior.

- Ask for discounts: Inquire about age-related discounts or incentives based on your driving history.

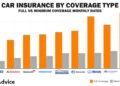

Customization of Insurance Quotes Based on Age and Driving History

Insurance companies analyze age and driving history to tailor quotes to individual customers. They consider factors such as accident history, traffic violations, and years of driving experience to assess risk. By customizing quotes, insurers can offer competitive rates that reflect the specific circumstances of each policyholder.

End of Discussion

In conclusion, understanding how your date of birth and driving history influence insurance rates is key to maximizing your savings and getting the best coverage possible. By leveraging this knowledge, you can navigate the world of car insurance with confidence and savvy.

Expert Answers

How does age impact car insurance quotes?

Age plays a significant role in determining insurance premiums, with younger drivers often facing higher rates due to perceived risk. Older drivers, on the other hand, may enjoy lower premiums based on their driving experience.

Can a clean driving record help lower insurance costs?

Absolutely. Maintaining a clean driving record, free of violations and accidents, can lead to discounted insurance quotes and better rates from insurance providers.

How can individuals use their age and driving history to negotiate better rates?

By understanding how insurance companies categorize different age groups and driving records, individuals can strategically leverage this information during negotiations to secure more favorable insurance rates.