Exploring the realm of auto insurance apps for your phone, this introduction sets the stage for an informative and engaging discussion. Dive into the world of insurance shopping at your fingertips.

Uncover the top-rated apps, compare insurance quotes effortlessly, and manage policies with ease—all at your convenience.

Researching Auto Insurance Apps

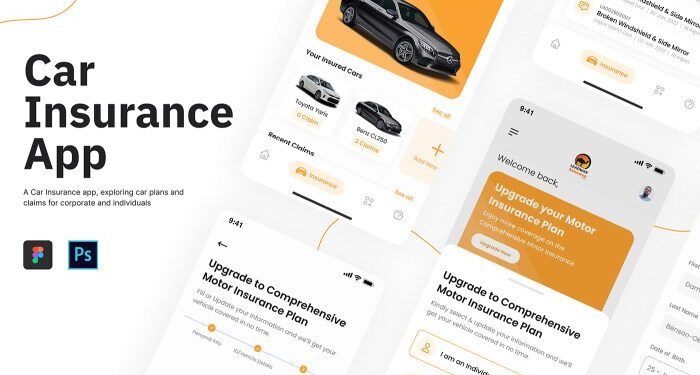

When it comes to finding the best auto insurance apps for your needs, it's essential to consider the top-rated options available in the market. These apps offer a range of features that can make managing your auto insurance policy a breeze.

Let's take a look at some of the key features that set these apps apart and explore user reviews and ratings to help you make an informed decision.

Top-Rated Auto Insurance Apps

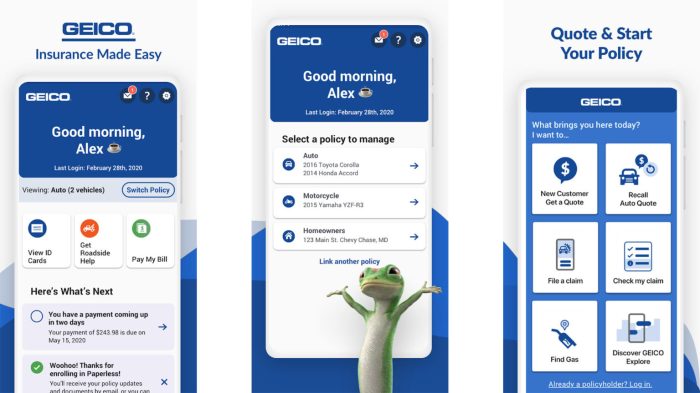

- Geico Mobile: Geico Mobile is a highly-rated auto insurance app that allows users to manage their policies, file claims, and access roadside assistance quickly and easily.

- Progressive: The Progressive app offers features such as Snapshot, which tracks your driving habits to potentially lower your rates, as well as easy policy management tools.

- State Farm: State Farm's app provides users with the ability to view and pay bills, file claims, and even get roadside assistance right from their phone.

Key Features of Auto Insurance Apps

- Policy Management: Many auto insurance apps allow users to view and manage their policies, make payments, and access important documents all in one place.

- Claims Filing: The ability to easily file a claim through the app can save you time and hassle in the event of an accident.

- Roadside Assistance: Some apps offer roadside assistance features that allow you to request help with just a few taps on your phone.

User Reviews and Ratings

- Geico Mobile: With a rating of 4.8 out of 5 stars on the App Store, users praise Geico Mobile for its user-friendly interface and convenient features.

- Progressive: The Progressive app has a rating of 4.7 out of 5 stars on Google Play, with users highlighting the Snapshot feature and easy claims process.

- State Farm: Users give the State Farm app a rating of 4.6 out of 5 stars on the App Store, noting its seamless policy management tools and responsive customer service.

Comparing Auto Insurance Quotes

When using auto insurance apps, users can easily compare quotes from various insurance providers to find the best deal that suits their needs and budget. The process of obtaining quotes through these apps is simple and efficient, allowing users to input their information once and receive multiple quotes in a matter of minutes.

Effective Tips for Comparing Quotes

- Input Accurate Information: Make sure to provide correct and up-to-date information about your driving history, vehicle, and coverage needs to receive accurate quotes.

- Compare Coverage Options: Look beyond just the price and compare the coverage options offered by different insurers to ensure you are getting the protection you need.

- Review Discounts: Check for any available discounts that can help lower your premium, such as safe driver discounts, multi-policy discounts, or good student discounts.

- Consider Customer Reviews: Take the time to read customer reviews and ratings of insurance companies to gauge their customer service and claims handling reputation.

- Look for Additional Benefits: Some insurers may offer additional benefits like roadside assistance, rental car coverage, or accident forgiveness, so consider these when comparing quotes.

Managing Policies and Claims

When it comes to managing insurance policies and filing claims, auto insurance apps offer users a convenient and efficient way to handle these tasks on the go. These apps streamline the process, making it easier for policyholders to stay up to date with their coverage and navigate through the claims process seamlessly.

Managing Insurance Policies

- Users can view and update their policy details, including coverage limits, deductibles, and premium payments.

- Notifications for policy renewals and important updates can be received directly through the app, keeping users informed.

- Policy documents and ID cards can be accessed and stored digitally within the app for easy reference.

Filing and Tracking Claims

- Claim filing can be done directly through the app by providing necessary details and documentation.

- Users can track the progress of their claims in real-time, from submission to resolution, without the need for constant follow-ups.

- Communication with claims adjusters and representatives can be facilitated through in-app messaging or chat features.

Unique Features for Policy Management

- Some apps offer virtual walkthroughs for filing claims, guiding users step-by-step through the process for a smoother experience.

- Integration with vehicle telematics allows for accurate assessment of damages and quick processing of claims.

- Personalized recommendations for coverage options based on user behavior and driving patterns can help optimize insurance policies.

Security and Privacy Features

When it comes to shopping for auto insurance on your phone, security and privacy are paramount. These apps implement various measures to protect user data and ensure confidentiality.

Security Measures

- Encryption: Auto insurance apps use encryption protocols to safeguard sensitive information like personal details and payment data.

- Two-factor authentication: Some apps offer two-factor authentication for an added layer of security when logging in or making changes to your account.

- Secure payment gateways: To protect financial transactions, these apps use secure payment gateways to prevent unauthorized access to payment information.

Privacy Features

- Data protection policies: Auto insurance apps have strict privacy policies in place to ensure that user information is not shared with third parties without consent.

- Anonymization of data: User data is often anonymized to protect individual identities while still allowing for personalized services.

- Permission controls: Users can control the permissions granted to the app, limiting access to certain data on their devices.

Additional Steps for Data Security

- Use strong passwords: Create strong, unique passwords for your auto insurance app accounts to prevent unauthorized access.

- Keep your app updated: Regularly update the app to ensure you have the latest security patches and features.

- Avoid public Wi-Fi: When using the app, avoid connecting to public Wi-Fi networks to reduce the risk of data interception.

Final Summary

In conclusion, navigating the landscape of auto insurance through apps can revolutionize the way you shop for coverage. With security features, policy management tools, and quote comparisons at your disposal, finding the best insurance deal has never been more convenient.

FAQ Guide

How can I compare auto insurance quotes using these apps?

To compare quotes, simply input your details and desired coverage options into the app. The app will then generate quotes from various insurance providers for easy comparison.

What are some unique features of these insurance apps?

Some apps offer features like policy management tools, claim filing assistance, and even real-time customer support for a seamless user experience.

Are these apps secure for handling sensitive insurance information?

Yes, these apps prioritize user data security with encryption protocols and data protection measures to ensure the safety of your personal information.