As Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing? takes center stage, this opening passage beckons readers with a captivating look into the evolving landscape of automotive insurance in the country. It promises to shed light on the shifting trends and factors affecting insurance quotes, providing a comprehensive view of the current scenario.

In the following paragraphs, we delve deeper into the key aspects of automotive insurance in Saudi Arabia, exploring the historical background, factors influencing quotes, emerging trends, and comparison of insurance providers.

Overview of Automotive Insurance in Saudi Arabia

Automotive insurance in Saudi Arabia has a history dating back to the early 20th century when the first insurance companies were established in the country. Over the years, the automotive insurance sector has evolved to meet the changing needs of drivers and regulatory requirements.

Having automotive insurance in Saudi Arabia is not only a legal requirement but also a crucial financial protection for drivers. In the event of an accident or damage to your vehicle, having insurance can help cover the costs of repairs or medical expenses, reducing the financial burden on the policyholder.

Statistics on the Number of Vehicles Insured in Saudi Arabia

- In 2020, there were over 10 million vehicles insured in Saudi Arabia, according to the Saudi Arabian Monetary Authority.

- The motor insurance market in Saudi Arabia is one of the largest in the Middle East region, with a high penetration rate of insurance policies.

- With the increasing number of vehicles on the road and the government's focus on road safety, the demand for automotive insurance is expected to continue growing in the coming years.

Factors Influencing Automotive Insurance Quotes

When it comes to determining automotive insurance quotes in Saudi Arabia, several key factors come into play. These factors can significantly impact the cost of insurance premiums for policyholders.

Type of Vehicle

The type of vehicle being insured is a crucial factor in determining insurance quotes. High-end luxury cars or sports vehicles typically come with higher insurance premiums due to their increased risk of theft or accidents. On the other hand, more affordable and common vehicles may have lower insurance costs.

Age and Driving Record of the Policyholder

The age and driving record of the policyholder also play a significant role in determining insurance premiums. Younger drivers or individuals with a history of accidents or traffic violations are considered higher risk by insurance companies, leading to higher premiums.

On the other hand, older drivers with a clean driving record often enjoy lower insurance rates due to their lower risk profile.

Emerging Trends in Automotive Insurance Quotes

In recent years, the automotive insurance landscape in Saudi Arabia has seen several emerging trends that are shaping the pricing and availability of insurance quotes for vehicle owners in the country

Integration of Telematics Technology

With the advancement of telematics technology, insurance companies in Saudi Arabia are increasingly adopting usage-based insurance (UBI) policies. These policies rely on real-time data collected from a vehicle's onboard telematics system to calculate insurance premiums. By analyzing driving behavior, such as speed, mileage, and braking patterns, insurers can offer personalized quotes to policyholders.

This trend has led to a more accurate assessment of risk and has the potential to reward safe drivers with lower premiums.

Shift towards Digital Platforms

The insurance industry in Saudi Arabia is undergoing a digital transformation, with insurers investing in online platforms to streamline the insurance purchasing process. Customers can now easily compare quotes, purchase policies, and manage claims through mobile apps and websites. This shift towards digital channels has increased competition among insurers, leading to more competitive pricing and customized insurance products tailored to individual needs.

Impact of COVID-19 on Insurance Rates

The COVID-19 pandemic has had a profound impact on the automotive insurance industry worldwide, including in Saudi Arabia. With changes in driving behavior due to lockdowns and restrictions, insurers have had to reassess their risk models and pricing strategies. As fewer vehicles were on the road during the pandemic, the frequency of accidents decreased, leading to a potential reduction in claims for insurers.

This shift in risk has influenced insurance rates, with some insurers offering discounts and rebates to policyholders to reflect the changing landscape.

Comparison of Insurance Providers

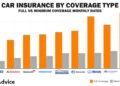

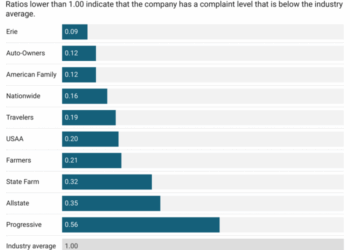

When choosing an insurance provider in Saudi Arabia, it is crucial to consider various factors such as coverage options, premium rates, and customer reviews. To help you make an informed decision, we have compiled a comparison table of different insurance providers in the country.

Insurance Provider A

| Coverage Options | Premium Rates | Customer Reviews |

|---|---|---|

| Comprehensive coverage with roadside assistance | Competitive rates based on vehicle type | Positive feedback on quick claim processing |

Insurance Provider B

| Coverage Options | Premium Rates | Customer Reviews |

|---|---|---|

| Basic coverage with add-on options | Affordable rates with discounts for safe drivers | Mixed reviews on customer service quality |

Insurance Provider C

| Coverage Options | Premium Rates | Customer Reviews |

|---|---|---|

| Customizable coverage plans | Higher premium rates for additional benefits | High satisfaction ratings for customer support |

By comparing the coverage options, premium rates, and customer reviews of different insurance providers, customers can evaluate which company aligns best with their needs. It is essential to prioritize reliable coverage, affordable rates, and positive customer feedback when selecting an insurance provider in Saudi Arabia.

Last Point

In conclusion, the dynamic nature of Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing? highlights the need for continuous monitoring and adaptation in the insurance sector. Stay informed to make well-informed decisions regarding your automotive insurance needs.

FAQ Resource

What factors influence automotive insurance quotes in Saudi Arabia?

Factors such as the type of vehicle, age of the policyholder, and driving record play a significant role in determining insurance premiums in Saudi Arabia.

How have technological advancements impacted insurance pricing in Saudi Arabia?

Technological advancements have led to more personalized pricing models, better risk assessment, and improved customer experiences in the automotive insurance sector in Saudi Arabia.

What recent trends have been observed in automotive insurance quotes in Saudi Arabia?

Recent trends include increased usage of telematics, growth in usage-based insurance, and a shift towards digital processes in acquiring insurance quotes in Saudi Arabia.