Automotive Insurance Quote Optimization: What Netherlands Drivers Should Know sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The content of the second paragraph that provides descriptive and clear information about the topic

Introduction to Automotive Insurance Quote Optimization

Automotive insurance quote optimization refers to the process of finding the best insurance coverage at the most competitive price for your vehicle. It involves comparing various quotes from different insurance providers to ensure you are getting the most value for your money.

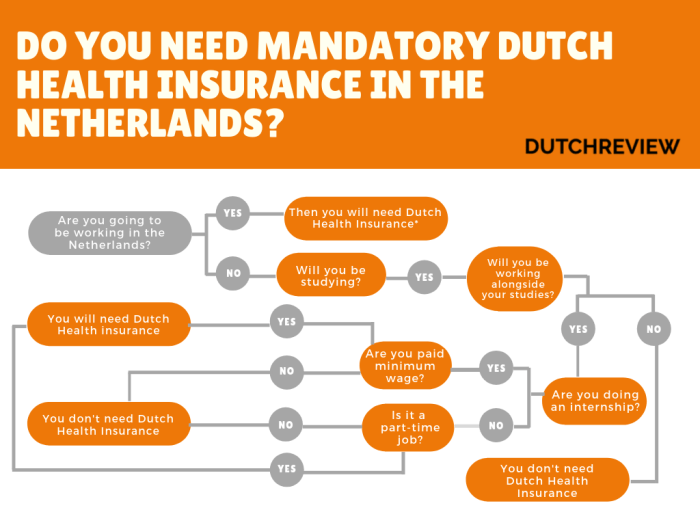

For Netherlands drivers, optimizing insurance quotes is crucial due to the legal requirement of having car insurance to drive on the road. By finding the right coverage at the best price, drivers can ensure they are financially protected in case of accidents or damages.

Additionally, optimizing insurance quotes can help drivers save money in the long run by avoiding overpaying for coverage they may not need.

Benefits of Finding the Right Insurance Coverage at the Best Price

- Cost savings: By comparing quotes and finding the best price, drivers can save money on their insurance premiums.

- Customized coverage: Optimizing insurance quotes allows drivers to tailor their coverage to meet their specific needs, ensuring they are not overpaying for unnecessary features.

- Peace of mind: Knowing you have the right coverage at the best price can provide peace of mind while driving, knowing you are financially protected in case of an accident.

- Legal compliance: Optimizing insurance quotes ensures that drivers meet the legal requirement of having car insurance, avoiding potential fines or penalties.

Factors Affecting Automotive Insurance Quotes in the Netherlands

In the Netherlands, several key factors play a crucial role in determining the cost of automotive insurance quotes.Age:Younger drivers, especially those under the age of 25, often face higher insurance premiums due to their lack of driving experience. Insurance companies perceive younger drivers as higher risk, which translates to increased costs.

On the other hand, older, more experienced drivers typically enjoy lower insurance rates.Driving Record:A driver's history of accidents, traffic violations, and claims significantly impacts insurance quotes. Those with a clean driving record are likely to receive lower premiums, as they are considered less risky to insure.

Conversely, individuals with a history of accidents or traffic violations may face higher insurance costs.Type of Vehicle:The make, model, and age of the vehicle being insured also influence insurance premiums. High-performance cars, luxury vehicles, and sports cars typically come with higher insurance costs due to their increased risk of theft or accidents.

On the other hand, more modest and safe vehicles are associated with lower insurance premiums.

Examples of How Different Factors Impact Insurance Costs

- For example, a 20-year-old driver with a history of accidents driving a sports car may face significantly higher insurance premiums compared to a 40-year-old driver with a clean record driving a sedan.

- Similarly, a brand new luxury vehicle will likely have higher insurance costs than a used compact car due to the replacement value and repair costs associated with the luxury vehicle.

Strategies for Optimizing Automotive Insurance Quotes

When it comes to optimizing automotive insurance quotes in the Netherlands, there are several strategies that drivers can implement to ensure they get the best coverage at the most competitive rates.

Comparing Quotes from Different Insurers

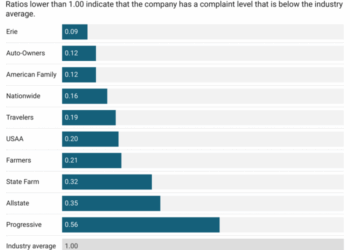

One of the most effective ways to optimize your automotive insurance quote is by comparing quotes from different insurers. Each insurance company has its own criteria for determining rates, so getting multiple quotes can help you find the best deal that suits your needs and budget.

Bundling Policies or Adjusting Coverage Levels

Another strategy to consider is bundling your policies or adjusting your coverage levels. Bundling your home and auto insurance, for example, can often lead to discounts. Additionally, by adjusting your coverage levels based on your driving habits and needs, you can potentially lower your insurance costs without compromising on protection.

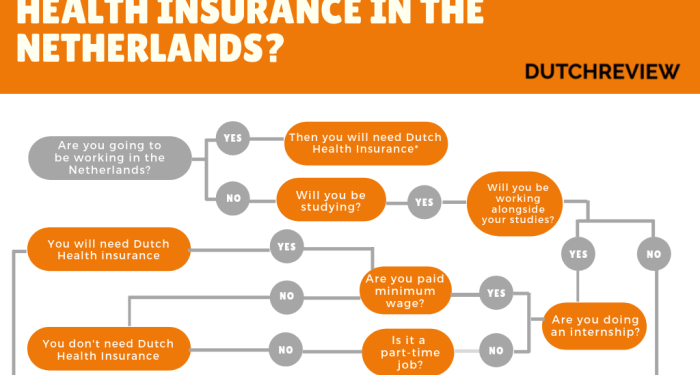

Understanding Insurance Coverage Options in the Netherlands

When it comes to insurance coverage options in the Netherlands, drivers have a few choices to consider. It's important to understand the different types of coverage available to make an informed decision that suits your needs and budget.

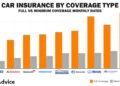

Common Types of Insurance Coverage

- Third-party Liability Insurance: This is the basic coverage required by law in the Netherlands. It covers damage to others in an accident where you are at fault.

- Comprehensive Insurance: This provides more extensive coverage, including damage to your own vehicle in accidents, theft, vandalism, and other incidents.

- Additional Coverage Options: Drivers can also opt for additional coverage such as legal assistance, roadside assistance, and no-claims protection.

Benefits of Basic vs. Comprehensive Coverage

While basic third-party liability insurance is the minimum legal requirement, comprehensive insurance offers broader protection. Here are some benefits to consider:

- Basic Coverage:Lower premiums, meets legal requirements, and covers damage to others.

- Comprehensive Coverage:Provides coverage for your own vehicle, theft, vandalism, and a wider range of incidents, offering more peace of mind.

Situations Requiring Additional Coverage

There are certain situations where additional coverage may be necessary to ensure you are adequately protected. For example:

- Living in a high-crime area where theft is more likely.

- Having a long commute or frequently driving long distances, increasing the risk of accidents.

- Traveling abroad frequently and needing coverage for driving in other countries.

Tips for Efficiently Comparing Insurance Quotes

When it comes to comparing insurance quotes in the Netherlands, there are several tips that can help drivers make an informed decision and find the best coverage for their needs.

Understanding Policy Details and Exclusions

Before comparing insurance quotes, it is crucial for drivers to understand the policy details and exclusions. This includes knowing the coverage limits, deductibles, additional benefits, and any specific conditions that may apply to the policy.

Knowing the policy details can prevent surprises and ensure that the insurance coverage meets your specific needs.

Utilizing Online Comparison Tools

One of the most efficient ways to compare insurance quotes is by using online comparison tools. These tools allow drivers to input their information once and receive multiple quotes from different insurance providers, making it easier to compare prices and coverage options.

Online comparison tools can save time and effort by providing a side-by-side comparison of insurance quotes, helping drivers choose the best option for their budget and coverage needs.

Final Wrap-Up

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Overview

What factors influence insurance quotes in the Netherlands?

Factors like age, driving record, and type of vehicle can significantly impact insurance premiums.

What are some strategies for optimizing automotive insurance quotes?

Netherlands drivers can optimize quotes by comparing from different insurers and bundling policies.

What are the common types of insurance coverage available in the Netherlands?

Common types include basic coverage and comprehensive coverage, each with its own benefits.