Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The landscape of automotive insurance in Saudi Arabia is evolving rapidly, influenced by various factors that shape trends and pricing. This article delves into the dynamic changes occurring in the automotive insurance sector, shedding light on the latest developments and what they mean for consumers.

Overview of Automotive Insurance in Saudi Arabia

Automotive insurance in Saudi Arabia plays a crucial role in protecting vehicle owners from financial losses in case of accidents or damages. It is mandatory for all vehicles to have insurance coverage in the country.

Main Types of Automotive Insurance

- Third-Party Liability Insurance: This type of insurance covers damages caused to a third party in case of an accident.

- Comprehensive Insurance: Comprehensive insurance provides coverage for damages to the insured vehicle as well as third-party liabilities.

Penetration of Automotive Insurance in Saudi Arabia

According to recent statistics, the penetration rate of automotive insurance in Saudi Arabia is around 60%, indicating a considerable level of insurance coverage among vehicle owners in the country.

Factors Influencing Automotive Insurance Trends

Several key factors are driving changes in automotive insurance trends in Saudi Arabia, including regulatory changes and economic factors.

Impact of Regulatory Changes

Regulatory changes play a significant role in shaping automotive insurance trends in Saudi Arabia. For example, the recent implementation of mandatory insurance policies has led to an increase in demand for coverage. Additionally, changes in regulations regarding minimum coverage requirements and claim procedures have influenced the pricing of insurance quotes.

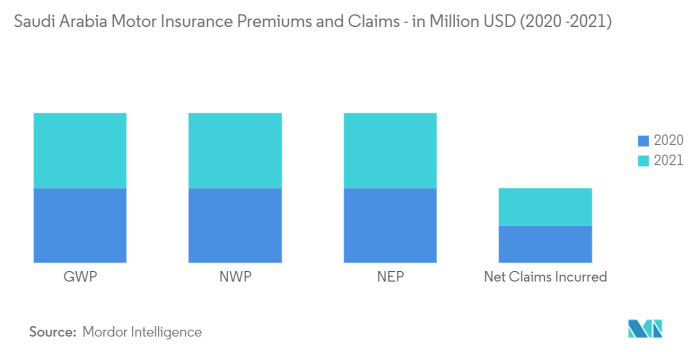

Economic Factors Affecting Pricing

Economic factors such as inflation, GDP growth, and exchange rates also impact the pricing of automotive insurance in Saudi Arabia. For instance, fluctuations in the economy can affect the cost of vehicle repairs, medical expenses, and overall claims, leading to adjustments in insurance premiums.

Moreover, changes in the cost of living and income levels can influence the affordability of insurance for consumers.

Technology's Role in Changing Insurance Quotes

Technology plays a significant role in the evolving landscape of automotive insurance quotes in Saudi Arabia. From telematics to AI, these advancements are reshaping how insurance premiums are determined and how consumers interact with insurance providers.

Telematics Impact on Insurance Pricing

Telematics, a technology that collects data on driving behaviors such as speed, braking, and mileage, is revolutionizing the insurance industry. Insurance companies can now offer usage-based insurance policies, where premiums are adjusted based on actual driving habits. This shift towards personalized pricing allows safer drivers to enjoy lower rates, incentivizing responsible behavior on the road.

Role of AI and Data Analytics in Premium Determination

AI and data analytics are being utilized to assess risk factors more accurately and efficiently. By analyzing vast amounts of data, including driver behavior, vehicle information, and external factors like weather conditions, AI can provide more accurate predictions of potential claims.

This enables insurance companies to tailor premiums to individual risk profiles, ultimately leading to fairer pricing for consumers.

Online Platforms Changing Insurance Quote Delivery

Online platforms have simplified the process of obtaining insurance quotes for consumers. With just a few clicks, individuals can compare rates from multiple providers, saving time and effort. Additionally, these platforms often offer tools that help users understand different coverage options and make informed decisions.

The convenience and transparency provided by online platforms are reshaping the way consumers interact with insurance companies, fostering a more competitive market.

Consumer Behavior Trends in Insurance Quotes

Consumer behavior plays a significant role in shaping the trends of insurance quotes in Saudi Arabia. Let's delve into how consumer preferences are driving changes in the insurance industry, particularly focusing on the shift towards personalized insurance policies and the impact of digitalization on consumer decision-making.

Shift towards Personalized Insurance Policies

Personalization has become a key trend in the insurance sector, with consumers seeking tailored insurance policies that cater to their specific needs and preferences. In Saudi Arabia, insurance companies are increasingly offering customized insurance plans that allow individuals to select coverage options based on their lifestyle, driving habits, and risk profile.

This shift towards personalized insurance policies not only enhances customer satisfaction but also helps insurers better manage risks and pricing.

- Insurance companies are leveraging data analytics and artificial intelligence to assess individual risk factors and create personalized insurance packages.

- Consumers are more inclined towards policies that offer flexibility in coverage, such as pay-as-you-drive or usage-based insurance.

- Personalized insurance plans promote transparency and trust between insurers and policyholders, leading to long-term customer loyalty.

Impact of Digitalization on Consumer Decision-Making

The digital transformation of the insurance industry has revolutionized how consumers research, compare, and purchase insurance quotes. In Saudi Arabia, the increasing use of online platforms and mobile apps has made it easier for consumers to access a wide range of insurance products and services, leading to a shift in consumer behavior when obtaining insurance quotes.

- Consumers now prefer the convenience of comparing multiple insurance quotes online, saving time and effort in the decision-making process.

- Digitalization has empowered consumers to make informed choices by providing access to detailed information about insurance coverage, premiums, and terms and conditions.

- Online customer reviews and ratings play a crucial role in influencing consumer decisions, as individuals rely on peer feedback to assess the credibility and reliability of insurance providers.

Conclusive Thoughts

In conclusion, Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing? paints a vivid picture of the shifting dynamics in the insurance landscape of the country. As innovations and regulations continue to mold the industry, staying informed about these changes is crucial for both insurers and policyholders alike.

Detailed FAQs

What are the main types of automotive insurance available in Saudi Arabia?

The main types of automotive insurance in Saudi Arabia include comprehensive coverage, third-party liability, and personal accident insurance.

How is technology like telematics impacting automotive insurance pricing?

Technology such as telematics is revolutionizing automotive insurance pricing by allowing insurers to track driver behavior and offer personalized premiums based on individual driving habits.

What is the impact of digitalization on consumer decision-making for insurance quotes?

Digitalization has streamlined the process of obtaining insurance quotes for consumers, providing more transparency and accessibility in comparing different options before making a decision.