Delve into the world of home and auto insurance bundles with the key question in mind: are they truly worth it? This topic explores the intricacies of bundling insurance policies, shedding light on the benefits and considerations that come with it.

Introduction to Home and Auto Insurance Bundles

Home and auto insurance bundles are combined insurance policies that offer coverage for both your home and your vehicle. By bundling these two types of insurance together, policyholders can often enjoy cost savings and convenience.

The concept of bundling insurance policies involves purchasing multiple insurance products from the same provider. This can include combining home and auto insurance, as well as other types of coverage like life insurance or renters insurance.

Examples of Common Insurance Bundles

- Home and Auto Insurance Bundle: This is one of the most popular bundles where homeowners combine their home insurance with their auto insurance for a discounted rate.

- Home, Auto, and Life Insurance Bundle: Some insurance companies offer a package deal that includes coverage for your home, car, and life insurance policy.

- Home and Renters Insurance Bundle: For those who own a home and also rent out another property, bundling home insurance with renters insurance can be a practical option.

Pros and Cons of Bundling Home and Auto Insurance

When considering bundling your home and auto insurance policies, it's important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Bundling Insurance Policies

- Potential Cost Savings: Bundling your home and auto insurance can often lead to significant discounts from insurance providers. This can result in lower premiums compared to purchasing separate policies.

- Convenience: Managing one insurance policy for both your home and auto can simplify the process of paying premiums, making claims, and communicating with your insurance company.

- Bundled Coverage Options: Some insurance companies offer unique coverage options or benefits specifically for policyholders who choose to bundle their home and auto insurance policies.

- Loyalty Discounts: Bundling your insurance policies with the same provider may make you eligible for loyalty discounts, further reducing your overall insurance costs over time.

Drawbacks of Opting for Bundled Insurance

- Limitations on Choice: When bundling your home and auto insurance, you may be limited to the coverage options provided by a single insurance company, potentially restricting your ability to tailor policies to your specific needs.

- Possible Loss of Discounts: In some cases, bundling policies may not always result in the lowest possible premium rates, especially if you are eligible for discounts with different providers for each type of insurance.

- Inflexibility: Changing or canceling a bundled insurance policy may be more complex than managing separate policies, leading to potential difficulties if your insurance needs change in the future.

- Unsuitable Coverage: Bundling policies could mean compromising on coverage levels or features that may be more beneficial when tailored separately, leaving you underinsured in certain areas.

Coverage Comparison between Individual and Bundled Policies

When comparing coverage between standalone home and auto insurance policies versus bundled policies, there are some key differences to consider. Bundling typically involves combining both home and auto insurance with the same provider, which may result in unique coverage benefits and limitations.

Specific Coverage Benefits in Bundled Policies

- Bundled policies often offer discounts on premiums, making it more cost-effective to have both home and auto insurance with the same provider.

- Some insurance companies may include additional coverage options or perks for policyholders who bundle, such as roadside assistance or identity theft protection.

- Having a bundled policy can streamline the claims process and make it easier to manage policies and payments.

Impact on Coverage Limits and Add-On Options

- While bundled policies can offer comprehensive coverage, they may also come with limitations on coverage amounts for certain types of claims.

- Policyholders should review the specifics of their bundled policy to understand any restrictions or exclusions that may apply.

- Some add-on options, such as umbrella coverage or specialized endorsements, may be more limited or not available with a bundled policy compared to standalone policies.

Factors to Consider When Deciding on Bundled Insurance

When deciding whether to bundle your home and auto insurance, there are several important factors to take into consideration. These factors can greatly impact the cost savings and convenience that come with bundling your policies.

Household Size and Location

One of the key factors to consider when deciding on bundled insurance is the size of your household and your location. Larger households may benefit more from bundling, as it can lead to lower overall premiums. Additionally, your location plays a significant role in determining your insurance rates.

Bundling your policies may result in discounts based on where you live.

Driving History

Your driving history is another crucial factor to consider. If you have a clean driving record, bundling your auto and home insurance could lead to substantial savings. On the other hand, if you have a history of accidents or traffic violations, bundling may not result in as much cost savings.

Home Features

The features of your home, such as security systems, fire alarms, and the overall condition of your property, can also influence your decision to bundle insurance. Some insurance companies offer discounts for certain home features, which can further reduce your premiums when bundling your policies.

Premium Costs Comparison

When deciding on bundled insurance, it's essential to compare the premium costs of individual policies versus a bundled package. Calculate the total cost of separate policies and compare it to the bundled rate to determine if bundling is cost-effective for your specific situation.

Ease of Managing Policies

Another factor to consider is how bundling affects the ease of managing your insurance policies. Bundling can streamline the process by combining your policies with one insurance provider, making it easier to manage payments, claims, and policy renewals. This convenience factor can be a significant benefit for those looking to simplify their insurance needs.

Customizing Bundled Policies to Suit Individual Needs

When it comes to bundled insurance policies, customization is key to ensuring that your coverage meets your specific needs. By tailoring your policy, you can make sure that you are adequately protected without paying for unnecessary extras.

Tailoring Coverage Levels and Add-Ons

One of the first steps in customizing a bundled policy is to adjust the coverage levels to match your individual requirements. This involves assessing your assets, liabilities, and potential risks to determine the appropriate amount of coverage for each aspect of your policy.

- Consider increasing coverage limits for high-value assets such as jewelry, art, or electronics.

- Adjust liability coverage based on your personal risk tolerance and financial situation.

- Evaluate your deductibles to find a balance between premium cost and out-of-pocket expenses.

Optional Coverages to Include

Adding optional coverages to your bundled policy can provide extra protection for specific risks that may not be covered by standard policies. These add-ons can be tailored to your needs and preferences, giving you peace of mind in knowing you are fully protected.

- Identity theft coverage to safeguard against cyber threats and financial fraud.

- Flood insurance for properties located in high-risk flood zones.

- Rental car reimbursement to cover the cost of a temporary vehicle in case of an accident.

Maximizing Savings and Discounts with Bundled Insurance

When it comes to bundled insurance policies, maximizing savings and discounts is a key advantage that many policyholders aim to achieve. By bundling your home and auto insurance together, you can potentially save a significant amount of money on your premiums.

Let's explore the different ways you can maximize your savings and discounts with bundled insurance.

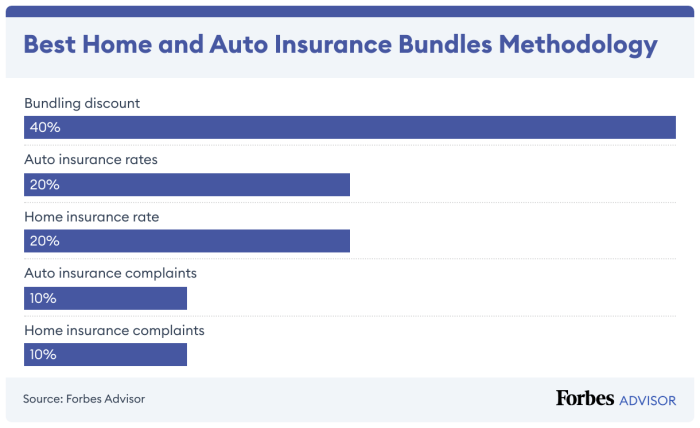

Types of Discounts Available for Bundling Home and Auto Insurance

- Multi-Policy Discount: Insurance companies often offer a discount when you bundle multiple policies together, such as home and auto insurance.

- Loyalty Discount: Some insurers reward long-time customers with additional discounts when they bundle their policies.

- Safety Features Discount: If your home or car has safety features like alarm systems or airbags, you may qualify for additional discounts on your premiums.

Maximizing Savings by Taking Advantage of Bundled Policy Discounts

- Review Your Coverage Needs: Make sure you are not overinsured or underinsured, as this can affect your premiums. Adjust your coverage limits accordingly to maximize your savings.

- Compare Quotes: Shop around and compare quotes from different insurance companies to ensure you are getting the best deal on your bundled policy.

- Ask About Additional Discounts: Inquire with your insurance provider about any other discounts you may qualify for when bundling your home and auto insurance policies.

Negotiating Better Rates When Bundling Insurance Policies

- Bundle More Than Two Policies: Some insurers offer additional discounts if you bundle more than just your home and auto insurance policies together.

- Improve Your Credit Score: Maintaining a good credit score can help you negotiate better rates when bundling insurance policies.

- Consider Higher Deductibles: Opting for higher deductibles can lower your premiums, making your bundled policy more cost-effective in the long run.

Final Review

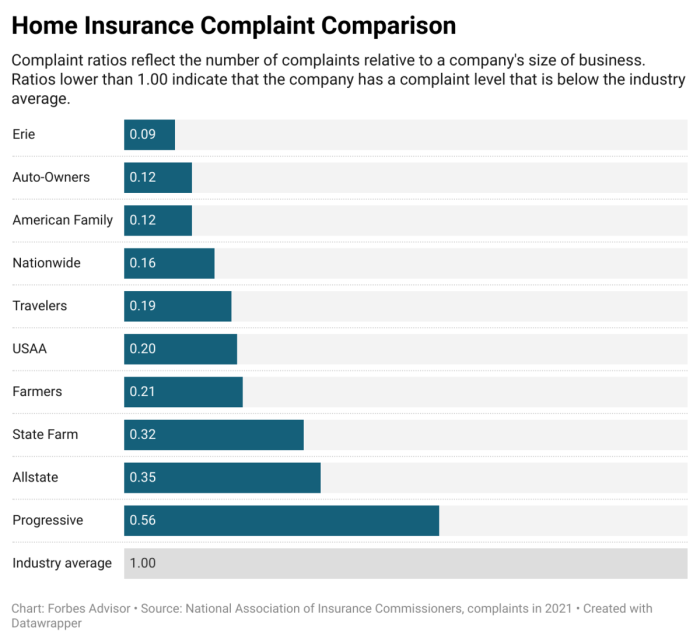

In conclusion, the comparison between standalone and bundled insurance policies reveals a nuanced landscape of choices. Understanding the nuances and potential savings can help make an informed decision when considering bundling home and auto insurance.

FAQ Corner

Are there any drawbacks to bundling home and auto insurance?

While bundling can lead to cost savings, it may limit your flexibility in choosing different insurance providers for each policy. Additionally, not all bundled policies may offer the same level of coverage customization as standalone policies.

How can I maximize discounts with bundled insurance?

To maximize discounts, consider factors like your driving record, home security features, and any additional insurance needs. Additionally, inquire with your insurance provider about all available discounts for bundled policies.