Exploring the disparities between Auto Policy Quotes and Full Coverage brings to light crucial insights that can impact your decision-making process. Dive into this comparison to uncover the nuances that define these two insurance options.

In this comprehensive guide, we will break down the key differences, cost implications, coverage extent, limitations, and considerations for choosing the right coverage.

Differences between Auto Policy Quotes and Full Coverage

When it comes to choosing the right insurance coverage for your vehicle, understanding the differences between auto policy quotes and full coverage is crucial. Auto policy quotes typically refer to the basic liability coverage required by law, while full coverage provides additional protection for your vehicle and yourself in case of accidents or other incidents.

Key Distinctions

- Auto Policy Quotes: Auto policy quotes usually include liability coverage, which helps pay for damages and injuries you cause to others in an accident.

- Full Coverage: Full coverage includes comprehensive and collision coverage in addition to liability, offering protection for your vehicle in various situations.

Scenarios for Each Type of Coverage

- Auto Policy Quotes: Auto policy quotes are more suitable for older vehicles with lower value or for individuals looking to meet the minimum legal requirements for insurance.

- Full Coverage: Full coverage is ideal for newer vehicles, leased vehicles, or vehicles with a higher value that would benefit from additional protection in case of accidents, theft, or other incidents.

Components Included

- Auto Policy Quotes: Auto policy quotes typically include bodily injury liability, property damage liability, and sometimes personal injury protection (PIP) or medical payments coverage.

- Full Coverage: Full coverage includes liability coverage, comprehensive coverage (for non-collision incidents like theft or vandalism), and collision coverage (for damage from accidents).

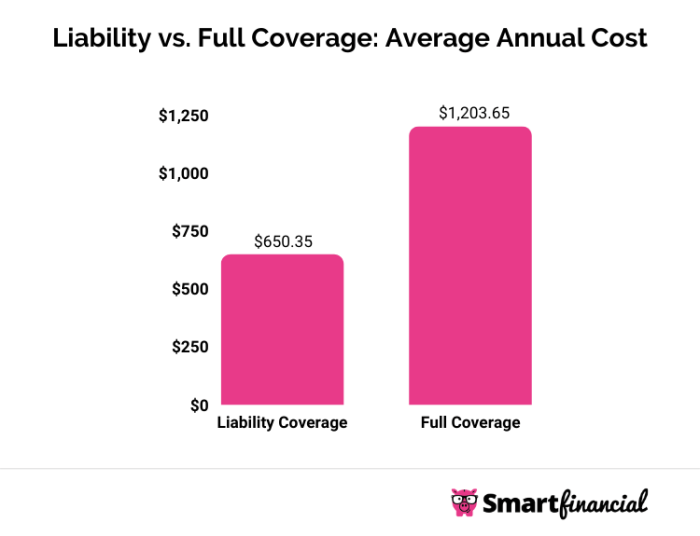

Cost Comparison

When comparing the cost implications of auto policy quotes versus full coverage, it's essential to consider several factors that can influence the overall expenses.

Factors Affecting Cost Difference

- Level of Coverage: Auto policy quotes typically offer less coverage than full coverage plans, which can result in lower premiums.

- Vehicle Value: The value of the vehicle plays a significant role in determining insurance costs. Full coverage is usually more expensive for newer and high-value cars.

- Driver's Profile: Factors such as age, driving history, and location can impact insurance rates differently depending on the type of coverage chosen.

- Deductibles: Opting for higher deductibles can reduce premiums but may also increase out-of-pocket expenses in the event of a claim.

Saving Money

- Comparing Quotes: Always shop around and compare quotes from different insurance providers to find the best rate for your desired coverage.

- Bundling Policies: Some insurers offer discounts for bundling auto and home insurance policies together, which can lead to savings.

- Driving Habits: Safe driving habits and maintaining a clean record can result in lower premiums over time, regardless of the coverage type chosen.

- Consider Your Needs: Evaluate your insurance needs and assess if full coverage is necessary based on the value of your vehicle and personal circumstances.

Coverage Extent and Limitations

When it comes to auto insurance, understanding the extent of coverage and any limitations or exclusions is crucial for making informed decisions. Let's delve into the specifics of coverage offered by auto policy quotes and full coverage.

Comparison of Coverage Extent

| Aspect | Auto Policy Quotes | Full Coverage |

|---|---|---|

| Bodily Injury Liability | Coverage for injuries to others in an accident where you are at fault. | Usually included with higher limits for more comprehensive protection. |

| Property Damage Liability | Coverage for damage to others' property in an accident you caused. | Typically covers repair or replacement costs for damaged property. |

| Collision Coverage | Optional coverage that pays for damage to your vehicle in a collision. | Includes coverage for repairs or replacement of your vehicle after a collision. |

| Comprehensive Coverage | Optional coverage for non-collision related incidents like theft or vandalism. | Covers damages from theft, vandalism, natural disasters, and more. |

| Uninsured/Underinsured Motorist Coverage | Protection if you're in an accident with a driver who has little or no insurance. | Provides coverage if you're in an accident with an uninsured or underinsured driver. |

Considerations for Choosing the Right Coverage

When deciding between auto policy quotes and full coverage, there are several important considerations individuals should keep in mind. To help make an informed decision, it's essential to weigh the pros and cons of each type of coverage and understand their key features.

Below is a checklist and a comparison chart to assist in choosing the right coverage.

Checklist of Considerations:

- Driving Habits: Consider how often and where you drive to determine the level of coverage needed.

- Vehicle Value: Evaluate the current value of your vehicle to see if full coverage is necessary to protect your investment.

- Budget: Determine how much you can afford to pay for insurance premiums and if full coverage fits within your financial means.

- State Requirements: Understand the minimum insurance requirements in your state to ensure compliance with the law.

- Risk Tolerance: Assess your comfort level with assuming more risk in case of an accident and choose coverage accordingly.

Pros and Cons Comparison:

| Auto Policy Quotes | Full Coverage |

|---|---|

| Pros: Lower Cost, Flexibility in Coverage Options | Pros: Comprehensive Protection, Covers Damage to Your Vehicle |

| Cons: Limited Coverage, Higher Out-of-Pocket Costs | Cons: Higher Premiums, Potential Over-Insurance |

Last Recap

As we conclude our analysis of Auto Policy Quotes vs Full Coverage, it becomes evident that understanding these distinctions is vital for selecting the most suitable insurance plan for your needs. Whether you prioritize cost-effectiveness or extensive coverage, this comparison equips you with the knowledge to make an informed choice.

Questions Often Asked

What are the key distinctions between Auto Policy Quotes and Full Coverage?

Auto Policy Quotes typically provide basic coverage for specific risks, while Full Coverage includes comprehensive protection for a wider range of scenarios.

How can individuals save money by choosing one type of coverage over the other?

Opting for Auto Policy Quotes may be more cost-effective for those looking to meet minimum insurance requirements, while Full Coverage offers greater protection but at a higher premium.

What considerations should individuals keep in mind when deciding between Auto Policy Quotes and Full Coverage?

Factors such as budget, driving habits, and the value of your vehicle should influence your choice between these two insurance options.