Exploring the relationship between credit scores and auto insurance quotes, this introduction aims to captivate readers with insightful information on how your credit score can influence the cost of your insurance premiums.

Providing a detailed overview of the factors at play, this paragraph sets the stage for a comprehensive discussion on this important financial aspect.

Understanding Credit Scores

Credit scores play a crucial role in various financial transactions, including determining your auto insurance quote. It is essential to understand how credit scores are calculated, the factors that influence them, and why they matter.

Calculation of Credit Scores

Credit scores are calculated based on several factors, including payment history, credit utilization, length of credit history, new credit accounts, and types of credit used. These factors are used to generate a three-digit number that represents an individual's creditworthiness.

Factors Influencing Credit Scores

Various factors can influence credit scores. Late payments, high credit card balances, and multiple credit inquiries can negatively impact your credit score. On the other hand, a history of on-time payments, low credit utilization, and a diverse credit mix can help improve your credit score.

Importance of Credit Scores

Credit scores matter in various financial transactions because they are used by lenders, landlords, and insurance companies to assess an individual's credit risk. A higher credit score indicates a lower credit risk, making it easier to qualify for loans, secure lower interest rates, and obtain better insurance premiums.

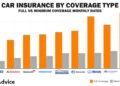

Impact of Credit Score on Auto Insurance

Having a good credit score can significantly impact the cost of your auto insurance premiums. On the other hand, a poor credit score can lead to higher insurance rates.

Good Credit Score Lowers Insurance Costs

When you have a good credit score, insurance companies view you as a low-risk customer, which can result in lower insurance premiums. Here are some examples of how a good credit score can lower your insurance costs:

- Insurance companies may offer you discounts or special rates for having a good credit score.

- You may qualify for better insurance coverage options at lower prices compared to those with poor credit scores.

- Insurance companies may consider you a responsible and reliable individual, leading to lower premiums.

Poor Credit Score Increases Insurance Rates

Conversely, having a poor credit score can lead to higher auto insurance rates. Here's how a poor credit score can impact your insurance costs:

- Insurance companies may consider you a higher-risk customer, resulting in increased premiums to offset the perceived risk.

- You may not qualify for certain discounts or benefits offered to those with good credit scores.

- Insurance companies may charge you higher rates to protect themselves against the potential of missed payments or claims.

Legal Aspects and Regulations

In the realm of insurance pricing, the use of credit scores has raised various legal and regulatory considerations. Let's delve into the legal aspects and regulations surrounding the utilization of credit scores in determining auto insurance quotes.

Legality of Using Credit Scores for Insurance Pricing

Insurance companies use credit scores to assess the risk associated with insuring an individual.

- Many states in the U.S. allow insurance companies to consider credit scores when determining insurance premiums.

- However, some states have restrictions or outright bans on the use of credit scores in insurance pricing.

- It is essential for insurance companies to comply with state laws and regulations regarding the use of credit scores to avoid legal issues.

Regulations Regarding the Use of Credit Scores

Regulations aim to ensure fairness and prevent discrimination in insurance pricing.

- The Fair Credit Reporting Act (FCRA) governs the use of credit information, including credit scores, by insurance companies.

- Insurance regulators may impose specific guidelines on how credit scores can be used in setting insurance rates to protect consumers.

- Some states require insurance companies to provide explanations to policyholders if their credit scores negatively impact their insurance premiums.

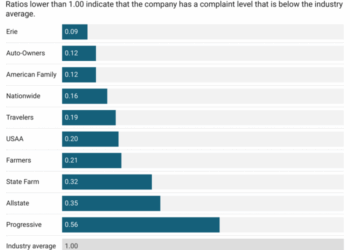

Justification of Correlation Between Credit Scores and Insurance Risk

Insurance companies argue that credit scores are indicative of a policyholder's financial responsibility and likelihood of filing claims.

- Statistical data suggests a correlation between lower credit scores and a higher frequency of insurance claims.

- Insurance companies believe that individuals with lower credit scores may exhibit riskier behavior, leading to more claims.

- By using credit scores as a factor in determining insurance premiums, insurers aim to price policies accurately based on the perceived risk.

Improving Credit Scores for Lower Insurance Costs

Improving your credit score can have a significant impact on the cost of your auto insurance. A higher credit score is often associated with lower insurance premiums, as it indicates to insurers that you are a lower-risk driver. Here are some strategies to help improve your credit score and ultimately lower your insurance costs:

Pay Your Bills on Time

- One of the most important factors in determining your credit score is your payment history. Make sure to pay all your bills on time, as missed or late payments can negatively impact your credit score.

Reduce Your Debt

- Try to reduce your overall debt and keep your credit card balances low. High amounts of debt can lower your credit score, so paying down your debt can help improve your score over time.

Check Your Credit Report Regularly

- Monitor your credit report regularly to check for any errors or inaccuracies that could be negatively impacting your score. Dispute any errors you find to help improve your credit score.

Avoid Opening Too Many New Accounts

- Opening multiple new credit accounts in a short period of time can lower your average account age and negatively impact your credit score. Try to only open new accounts when necessary.

Maintain a Good Credit Mix

- Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can help improve your credit score. It shows that you can responsibly manage different types of credit.

Use Credit Responsibly

- Make sure to use credit responsibly and avoid maxing out your credit cards. Keeping your credit utilization low and only applying for credit when needed can help improve your credit score.

Last Word

In conclusion, understanding how your credit score impacts your auto insurance quote is crucial in managing your overall financial well-being. By recognizing the significance of maintaining a good credit score, you can potentially save on insurance costs and secure better deals in the long run.

Commonly Asked Questions

How does a credit score affect auto insurance quotes?

Your credit score can directly impact the cost of your auto insurance premiums. A good credit score can lead to lower insurance costs, while a poor credit score may result in higher rates. Insurers often use credit scores as a factor in determining risk levels and setting prices.

Are there legal regulations regarding the use of credit scores in insurance pricing?

Yes, there are regulations in place governing the use of credit scores for insurance pricing. Insurers must adhere to these regulations to ensure fair practices and prevent discrimination based on credit history.

How can one improve their credit score to lower insurance costs?

Improving your credit score involves strategies such as paying bills on time, reducing debts, and monitoring your credit report regularly. By raising your credit score, you can potentially qualify for more affordable insurance rates.