Delve into the world of hop Car Insurance Quotes: Multi-Country Comparison (US, UK, India) where we explore the intricacies of insurance markets across different countries. Brace yourself for a journey filled with valuable insights and comparisons that will help you navigate the world of car insurance.

The following paragraphs offer detailed information on various aspects of car insurance quotes and comparisons in the US, UK, and India.

Overview of Car Insurance Quotes Comparison

Car insurance quotes are estimates provided by insurance companies that Artikel the cost of insuring a specific vehicle based on various factors such as the driver's age, driving history, and the type of coverage required. Comparing car insurance quotes from different countries is essential to ensure that you are getting the best possible deal and coverage for your vehicle.

Importance of Comparing Quotes from Different Countries

When comparing car insurance quotes across multiple countries, it is important to consider the differences in insurance regulations, coverage options, and pricing structures. Each country has its own unique insurance market, and by comparing quotes, you can identify the best options available to you based on your specific needs and budget.

- Insurance Regulations: Different countries have varying regulations that impact the type of coverage available and the cost of insurance premiums.

- Coverage Options: Insurance companies in different countries may offer different coverage options, so comparing quotes allows you to find the most suitable coverage for your vehicle.

- Pricing Structures: Insurance premiums are calculated differently in each country, so comparing quotes helps you find the most cost-effective option.

Introduction to Insurance Markets in the US, UK, and India

In the United States, the car insurance market is highly competitive, with a wide range of coverage options and providers. The UK also has a competitive insurance market, with various insurers offering different types of coverage. In India, the car insurance market is growing rapidly, with an increasing number of insurers providing a variety of coverage options to meet the needs of drivers in the country.

Car Insurance Regulations in the US, UK, and India

In each country, car insurance regulations play a crucial role in shaping the insurance market and affecting the pricing of insurance quotes. Let's compare and contrast the regulatory frameworks for car insurance in the US, UK, and India, and explore how these regulations impact the cost of car insurance in each country.

Minimum Coverage Requirements

In the US, each state has its own minimum liability coverage requirements for car insurance. For example, in California, drivers must have a minimum coverage of $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage.

On the other hand, in the UK, all drivers are legally required to have at least third-party car insurance. In India, the Motor Vehicles Act mandates that all vehicles must have third-party liability insurance.

No-Fault Insurance

In the US, some states have "no-fault" insurance laws, which means that drivers turn to their own insurance company to cover medical expenses regardless of who is at fault in an accident. This impacts insurance pricing as it can lead to higher premiums.

The concept of "no-fault" insurance is not common in the UK or India, where fault is typically determined in accidents and insurance claims accordingly.

Regulatory Bodies

The US has state insurance departments that regulate insurance practices within each state, while the UK has the Financial Conduct Authority (FCA) overseeing insurance regulations. In India, the Insurance Regulatory and Development Authority of India (IRDAI) regulates the insurance sector.

These regulatory bodies set guidelines and standards that impact insurance pricing and coverage options in each country.

Impact on Pricing

Regulations such as mandatory coverage requirements, no-fault insurance laws, and oversight by regulatory bodies can significantly impact the pricing of car insurance in the US, UK, and India. For example, the level of minimum coverage required, the presence of no-fault laws, and the regulatory environment can all influence the cost of insurance premiums for drivers in each country.

Types of Coverage Offered

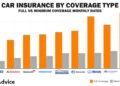

When it comes to car insurance coverage, the options available can vary from country to country. In the US, UK, and India, there are common types of coverage offered, each with its own set of limits and benefits.In the US, the most common types of car insurance coverage include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection.

These coverages provide financial protection in case of accidents, theft, or other unforeseen events.Similarly, in the UK, car insurance coverage typically includes third-party only, third-party, fire and theft, and comprehensive coverage. Each type of coverage offers different levels of protection and benefits, with comprehensive coverage being the most extensive.In India, car insurance coverage options usually consist of third-party liability coverage and comprehensive coverage.

Third-party liability coverage is mandatory by law and provides protection against damages caused to a third party. On the other hand, comprehensive coverage offers additional benefits such as coverage for own damages, theft, and natural calamities.

Comparison of Coverage Options and Limits

In the US, liability coverage is required by law in most states, with minimum coverage limits varying by state

Third-party, fire and theft coverage includes additional protection against fire and theft, while comprehensive coverage offers the highest level of protection, including coverage for own damages.In India, third-party liability coverage is mandatory, with limits prescribed by the Insurance Regulatory and Development Authority of India (IRDAI).

Comprehensive coverage, on the other hand, provides broader protection with higher limits for own damages, theft, and natural calamities.

Unique Coverage Options

One unique coverage option in the US is uninsured/underinsured motorist coverage, which protects policyholders in case of accidents with drivers who have insufficient insurance coverage. This coverage is not commonly found in the UK or India.Overall, while the basic types of car insurance coverage are similar across the US, UK, and India, the specific options and limits can vary significantly.

It's essential for drivers to understand the coverage options available in their country and choose the one that best suits their needs and budget.

Factors Influencing Insurance Premiums

Insurance premiums for car insurance can be influenced by various factors in the US, UK, and India. These factors play a crucial role in determining the cost of coverage for drivers in each country.

Demographic Factors

Different demographic factors such as age, gender, marital status, and occupation can impact insurance premiums. For example, younger drivers in the US tend to pay higher premiums due to their lack of experience on the road, while in the UK, gender can also affect insurance costs with women typically paying less than men.

Driving Behavior

Driving behavior, including past driving record, frequency of accidents or traffic violations, and mileage driven, can significantly impact insurance premiums. In India, a history of accidents or violations can lead to higher premiums, while in the UK, a clean driving record can result in lower costs.

Vehicle Types

The type of vehicle being insured, including make, model, age, and safety features, can also influence insurance premiums. For instance, sports cars in the US may come with higher premiums due to their higher risk of accidents, while in India, older vehicles might have lower premiums due to their lower value.

Obtaining and Comparing Quotes

When it comes to obtaining and comparing car insurance quotes in the US, UK, and India, there are specific processes and tools available to help you make an informed decision.

Process of Obtaining Quotes

In the US, you can obtain car insurance quotes by directly contacting insurance companies, using online quote comparison websites, or working with insurance agents. In the UK, you can visit insurance company websites, use price comparison websites, or seek assistance from insurance brokers.

In India, you can request quotes from insurance companies online, visit their branches, or contact agents for personalized quotes.

Tools for Comparing Quotes

There are various platforms available to compare car insurance quotes across multiple countries. In the US, websites like Progressive, GEICO, and Esurance offer comparison tools. In the UK, platforms like Compare the Market, Confused.com, and MoneySuperMarket are popular choices. In India, websites such as Policybazaar, Coverfox, and BankBazaar provide tools for comparing quotes.

Tips for Effective Comparison

- Be sure to compare similar coverage options when evaluating quotes.

- Consider the reputation and financial stability of the insurance company.

- Look for discounts or special offers that can help lower your premium.

- Review the policy details carefully, including exclusions and limitations.

- Don't forget to factor in customer reviews and service quality when making your decision.

Wrap-Up

As we come to the end of this discussion on hop Car Insurance Quotes: Multi-Country Comparison (US, UK, India), take away a comprehensive understanding of the key factors to consider when comparing quotes and the nuances of insurance markets in different countries.

Make informed decisions when it comes to choosing the right car insurance coverage for your needs.

Clarifying Questions

What are the key factors to consider when comparing car insurance quotes across multiple countries?

Key factors include regulatory frameworks, types of coverage offered, unique regulations in each country, and factors influencing insurance premiums.

How can I effectively compare quotes to find the best coverage at a competitive price?

Utilize tools and platforms available for comparing quotes, consider coverage options and limits provided in each country, and analyze how demographic factors and driving behavior impact insurance costs.