As Shop Auto Insurance for Luxury Cars: What to Expect takes center stage, this opening passage beckons readers with a captivating overview of the unique world of luxury car insurance. From understanding what sets luxury cars apart to exploring coverage options and factors influencing rates, this guide promises to unravel the complexities of insuring high-end vehicles.

Understanding Luxury Cars and Insurance

Luxury cars are typically defined by their high-quality materials, advanced technology features, superior performance, and prestigious brand reputation in the auto industry. These vehicles often come with a hefty price tag due to their luxurious design and exclusive amenities.

Factors that Make Insuring Luxury Cars Different

- Luxury cars have higher repair and replacement costs: Due to the use of expensive parts and specialized technology, repairing or replacing components in luxury vehicles can be significantly more costly compared to regular cars.

- Increased risk of theft or vandalism: Luxury cars are often targeted by thieves or vandals due to their high value, making them a higher risk for insurance companies.

- Advanced safety and security features: While luxury cars come equipped with state-of-the-art safety and security systems, the complexity of these features can lead to higher repair costs in the event of an accident.

Reasons for Higher Insurance Premiums

- Higher vehicle value: The overall value of luxury cars is greater than that of regular vehicles, leading to higher insurance premiums to cover potential losses.

- Increased repair costs: As mentioned earlier, the cost of repairing or replacing parts in luxury cars is usually higher, resulting in higher premiums to offset these expenses.

- Greater risk factors: Due to the increased likelihood of theft, vandalism, or accidents involving luxury cars, insurance companies adjust premiums to reflect the elevated risks associated with insuring these vehicles.

Coverage Options for Luxury Cars

When it comes to insuring luxury cars, there are specific coverage options that cater to the unique needs of these high-end vehicles. Understanding the different types of insurance coverage available for luxury cars is essential to ensure proper protection and peace of mind.

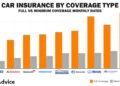

Comprehensive Coverage vs. Basic Insurance

Comprehensive coverage is a more extensive form of insurance that provides protection against a wide range of risks, including theft, vandalism, and natural disasters. It typically includes coverage for damages to your vehicle that are not caused by a collision.

On the other hand, basic insurance, such as liability coverage, may not fully protect your luxury car in the event of an accident or damage.

- Comprehensive coverage offers a higher level of protection for luxury cars, covering a broader range of risks compared to basic insurance.

- Basic insurance, while mandatory in most states, may not provide sufficient coverage for repairing or replacing a luxury vehicle in the event of a claim.

Specialized Coverage Options

In addition to comprehensive coverage, luxury car owners may benefit from specialized insurance options tailored to their specific needs. One such option is agreed value coverage, which guarantees a predetermined value for your vehicle in the event of a total loss.

Agreed value coverage ensures that you receive the full appraised value of your luxury car, providing peace of mind and financial protection.

- Agreed value coverage is ideal for rare or vintage luxury cars whose value may appreciate over time.

- This specialized coverage option eliminates the uncertainty of standard insurance policies, which may not fully compensate for the true value of a luxury vehicle.

Factors Influencing Auto Insurance Rates for Luxury Cars

When it comes to insuring luxury cars, several factors come into play that can influence the insurance rates. Insurers take into consideration various aspects to determine the premiums for these high-end vehicles.

Make, Model, and Value of the Luxury Car

The make, model, and value of a luxury car play a significant role in determining insurance rates. Luxury cars are typically more expensive to repair or replace due to their high-end features and advanced technology. As a result, insurance premiums are often higher for luxury vehicles compared to standard cars.

- The make of the car: Certain luxury brands are associated with higher repair costs, which can lead to higher insurance premiums.

- The model of the car: Specific models within a luxury brand may have higher rates based on their performance capabilities, safety features, and likelihood of theft.

- The value of the car: The higher the value of the luxury car, the more it will cost to insure, as insurers need to account for potential repair or replacement costs.

Personal Factors and Location

In addition to the make, model, and value of the luxury car, personal factors and location can also impact insurance costs. Insurers consider the following aspects:

- Driving history: A clean driving record with no accidents or traffic violations can lead to lower insurance rates, while a history of accidents or tickets may result in higher premiums.

- Location: Where the luxury car is primarily parked and driven can affect insurance rates. Urban areas with higher rates of accidents or theft may lead to increased premiums.

- Mileage: The annual mileage of a luxury car can impact insurance rates, as more time on the road increases the risk of accidents.

Tips for Shopping Auto Insurance for Luxury Cars

When it comes to insuring luxury cars, it's essential to follow a specific approach to ensure you get the best coverage at the most competitive rates. Here are some tips to guide you through the process:

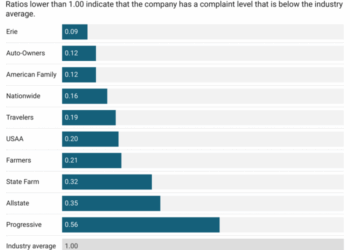

Research Insurance Companies Specializing in Luxury Cars

Before diving into the world of auto insurance for luxury vehicles, take the time to research insurance companies that specialize in providing coverage for high-end cars. These companies have a better understanding of the unique needs of luxury car owners and can offer tailored policies that provide comprehensive coverage.

Compare Multiple Quotes

Don't settle for the first insurance quote you receive. Shop around and compare quotes from different insurance providers to find the best deal for your luxury car. Consider factors such as coverage limits, deductibles, and additional benefits offered by each policy.

Look for Discounts and Deals

Insurance companies often offer discounts for various reasons, such as having multiple policies with the same provider, being a safe driver, or installing security features in your luxury car. Take advantage of these discounts to lower your insurance premiums while still maintaining adequate coverage.

Consider Bundling Insurance Policies

If you have other insurance needs, such as homeowners or life insurance, consider bundling them with your luxury car insurance policy. Many insurance companies offer discounts for bundling multiple policies, which can result in significant savings in the long run.

Review Coverage Options Carefully

When selecting an insurance policy for your luxury car, make sure to review the coverage options carefully. Ensure that the policy provides adequate coverage for your vehicle's value, liability limits, and any additional features you want to protect. Don't skimp on coverage to save money in the short term.

Ultimate Conclusion

In conclusion, navigating the realm of auto insurance for luxury cars demands a keen eye for detail and a thorough understanding of the intricacies involved. By arming yourself with knowledge and exploring the tips provided, you can confidently traverse the landscape of luxury car insurance with clarity and assurance.

FAQ Resource

What factors make insuring luxury cars different from regular vehicles?

Insuring luxury cars involves higher premiums due to their high value, expensive parts, and specialized repair requirements.

Why are insurance premiums for luxury cars typically higher?

Insurance premiums for luxury cars are higher because of the increased cost of repairs, replacement parts, and the elevated risk of theft or damage.

What are some specialized coverage options available for luxury cars?

Specialized coverage options for luxury cars include agreed value coverage, which ensures you receive the car's full insured value in case of a total loss.

How do personal factors like driving history and location affect insurance costs for luxury vehicles?

Personal factors like driving history and location can influence insurance costs for luxury cars by impacting the perceived risk associated with insuring these high-end vehicles.