As you delve into the world of auto insurance, steering clear of these 5 common mistakes can make all the difference. Get ready for a journey filled with insights and tips to ensure you make informed decisions when it comes to protecting your vehicle.

Exploring the key factors and pitfalls to avoid when shopping for auto insurance will arm you with the knowledge needed to navigate this crucial aspect of car ownership.

Factors to Consider When Shopping for Auto Insurance

When shopping for auto insurance, there are several key factors that you need to consider in order to make an informed decision and get the best coverage for your needs.

Key Factors Influencing Auto Insurance Rates

- Driving Record: Your driving history, including any accidents or traffic violations, can significantly impact your insurance rates. A clean record usually means lower premiums.

- Vehicle Type: The make and model of your car can also affect your insurance rates. More expensive or high-performance vehicles may come with higher premiums.

- Location: Where you live plays a role in determining your insurance rates. Urban areas with higher rates of accidents or theft may result in higher premiums.

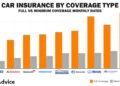

- Coverage Options: The type and amount of coverage you choose will directly impact your insurance costs. Understanding the different options available can help you find the right balance between coverage and affordability.

Comparison of Coverage Options

- Liability Coverage: This covers damage or injury you cause to others in an accident.

- Collision Coverage: This pays for repairs to your own vehicle in case of an accident.

- Comprehensive Coverage: This covers damage to your vehicle from non-accident related incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you're in an accident with a driver who doesn't have insurance or enough coverage.

Impact of Personal Factors on Insurance Premiums

- Age: Younger drivers typically pay higher premiums due to their lack of driving experience.

- Driving History: A clean driving record can lead to lower insurance rates, while accidents or violations can increase your premiums.

- Credit Score: In some states, your credit score can affect your insurance rates as it is seen as an indicator of risk.

- Marital Status: Married individuals may qualify for lower rates as they are seen as more responsible drivers.

Common Mistakes People Make When Choosing Auto Insurance

When it comes to selecting auto insurance, there are common mistakes that many people make which can result in inadequate coverage or higher premiums. It's important to be aware of these pitfalls and learn how to avoid them to make informed decisions about your coverage.

1. Choosing the Minimum Coverage Required by Law

Some drivers opt for the minimum coverage required by law to save money on premiums. However, this can leave you vulnerable in case of accidents that result in costly damages. For example, if you only have liability coverage and are at fault in an accident, you will be responsible for paying for your own repairs out of pocket.

2. Neglecting to Shop Around for Quotes

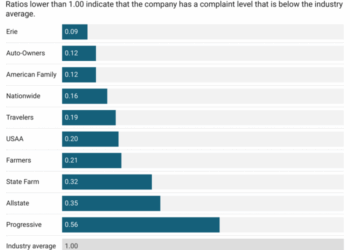

Another mistake is failing to compare quotes from multiple insurance companies. Each insurer uses different criteria to determine rates, so you may be missing out on potential savings by not exploring your options. Getting quotes from several companies can help you find the best coverage at the most competitive price.

3. Overlooking Discounts You May Qualify For

Many people overlook potential discounts they may qualify for, such as safe driver discounts, multi-policy discounts, or discounts for taking a defensive driving course. By not taking advantage of these savings opportunities, you could end up paying more for your auto insurance than necessary.

4. Focusing Only on the Premium Cost

While the cost of premiums is important, it's also crucial to consider the coverage limits, deductibles, and exclusions of a policy. Choosing a policy solely based on price without considering the level of coverage it provides can lead to gaps in protection when you need it most.

5. Forgetting to Update Your Policy Regularly

Life changes such as moving to a new location, purchasing a new vehicle, or adding a new driver to your policy can impact your insurance needs. Failing to update your policy regularly can result in inadequate coverage or overpaying for coverage you no longer need.

It's essential to review your policy annually and make adjustments as needed

Understanding Policy Details

When it comes to auto insurance, understanding the policy details is crucial to ensuring you have the right coverage to protect you in various situations.

Auto insurance policies typically consist of different components, each serving a specific purpose. Here are the main types of coverage you may encounter:

Liability Coverage

Liability coverage helps cover costs associated with injuries or property damage you may cause to others in an accident where you are at fault. This coverage is typically required by law and helps protect you from financial responsibility in case of a lawsuit.

Comprehensive Coverage

Comprehensive coverage helps pay for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters. This coverage is optional but can provide valuable protection in various scenarios.

Collision Coverage

Collision coverage helps cover repair costs for your vehicle if you are involved in a collision with another vehicle or object. This coverage is also optional but can be essential in ensuring your vehicle is repaired or replaced in case of an accident.

Understanding the significance of each type of coverage can help you make informed decisions when selecting an auto insurance policy that meets your needs. For example, having comprehensive coverage can give you peace of mind knowing that your vehicle is protected from a range of risks beyond just accidents.

Shopping Around for the Best Deals

When looking for auto insurance, it's crucial to shop around and compare quotes from multiple insurance providers. This can help you find the best deals without compromising on coverage. Insurance premiums can vary significantly based on the provider and the coverage options you choose.

Importance of Comparing Quotes

Comparing quotes from different insurance companies allows you to find the most competitive rates for the coverage you need. It gives you a better understanding of the market and helps you make an informed decision.

Tips for Effectively Shopping Around

- Get quotes from at least three different insurance providers to compare prices and coverage options.

- Consider bundling your auto insurance with other policies like home or renters insurance to potentially save money.

- Look for discounts that you may qualify for, such as safe driver discounts or discounts for having anti-theft devices installed in your car.

- Review the coverage limits and deductibles offered by each provider to ensure they meet your needs.

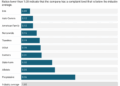

Variation in Insurance Premiums

Insurance premiums can vary based on factors like your driving record, age, location, and the type of coverage you choose. Different insurance companies may also weigh these factors differently, leading to varying premium rates. By shopping around, you can find the best deal that fits your budget and coverage requirements.

Avoiding Overlooking Discounts and Savings Opportunities

When shopping for auto insurance, it is crucial not to overlook the potential discounts and savings opportunities that insurance companies offer. By taking advantage of these discounts, you can significantly lower your insurance costs and maximize your savings. Here are some important points to consider:

Different Discounts Offered by Insurance Companies

- Safe Driver Discounts: Insurance companies often offer discounts to drivers who have a clean driving record and have not been involved in accidents.

- Bundling Discounts: You can save money by bundling your auto insurance with other types of insurance, such as home or renters insurance, with the same company.

How Discounts Lower Insurance Costs

- By availing of discounts, you can reduce the overall premium you pay for your auto insurance policy.

- Discounts help offset the cost of insurance, making it more affordable for you in the long run.

Tips to Maximize Savings through Discounts

- Shop around and compare quotes from different insurance companies to find the best discounts available.

- Ask your insurance agent about all the discounts you may be eligible for and how to qualify for them.

- Consider factors such as your driving record, age, and the type of vehicle you drive to determine which discounts you can take advantage of.

Conclusion

In conclusion, being aware of these mistakes and understanding the nuances of auto insurance can empower you to make the best choices for your coverage needs. Remember, a little knowledge can go a long way in securing the right protection for your vehicle.

Key Questions Answered

What are some common mistakes people make when choosing auto insurance?

Common mistakes include underestimating coverage needs, not comparing quotes, overlooking discounts, not understanding policy details, and ignoring personal factors affecting premiums.

How can policy details impact the overall insurance experience?

Policy details can determine what is covered in case of accidents or damages, affecting how much you pay out of pocket and how well you are protected in different scenarios.

Why is it important to shop around for the best auto insurance deals?

Shopping around allows you to compare prices, coverage options, and discounts offered by different providers, ensuring you get the best value for your insurance needs.

What are some common discounts that can help lower insurance costs?

Insurance companies offer discounts for safe driving records, bundling policies, vehicle safety features, and more, which can significantly reduce your insurance premiums.

How can individuals maximize savings on auto insurance through discounts and incentives?

To maximize savings, individuals should inquire about all available discounts, bundle policies if possible, maintain a clean driving record, and explore loyalty programs offered by insurance providers.